Access flexible personal loans tailored to your needs, whether it's for education, home improvement, or any other personal expenses.

Our personal loans come with flexible repayment terms and competitive interest rates. We understand that everyone's needs are different, which is why we offer customized solutions to help you achieve your goals.

Fuel your business growth with our comprehensive business loan solutions designed for entrepreneurs and established businesses.

Our business loans are designed to help you expand operations, purchase equipment, or manage cash flow. We work closely with you to understand your business needs and provide the right financial solution.

Start your journey to financial security with our range of savings accounts offering competitive interest rates and flexible terms.

Our savings accounts are designed to help you grow your wealth while maintaining easy access to your funds. Choose from various account types to match your savings goals and timeline.

Grow your wealth with our diverse range of investment products designed to meet your financial goals and risk appetite.

Our investment plans offer a range of options from conservative to aggressive, allowing you to build a portfolio that matches your financial goals and risk tolerance.

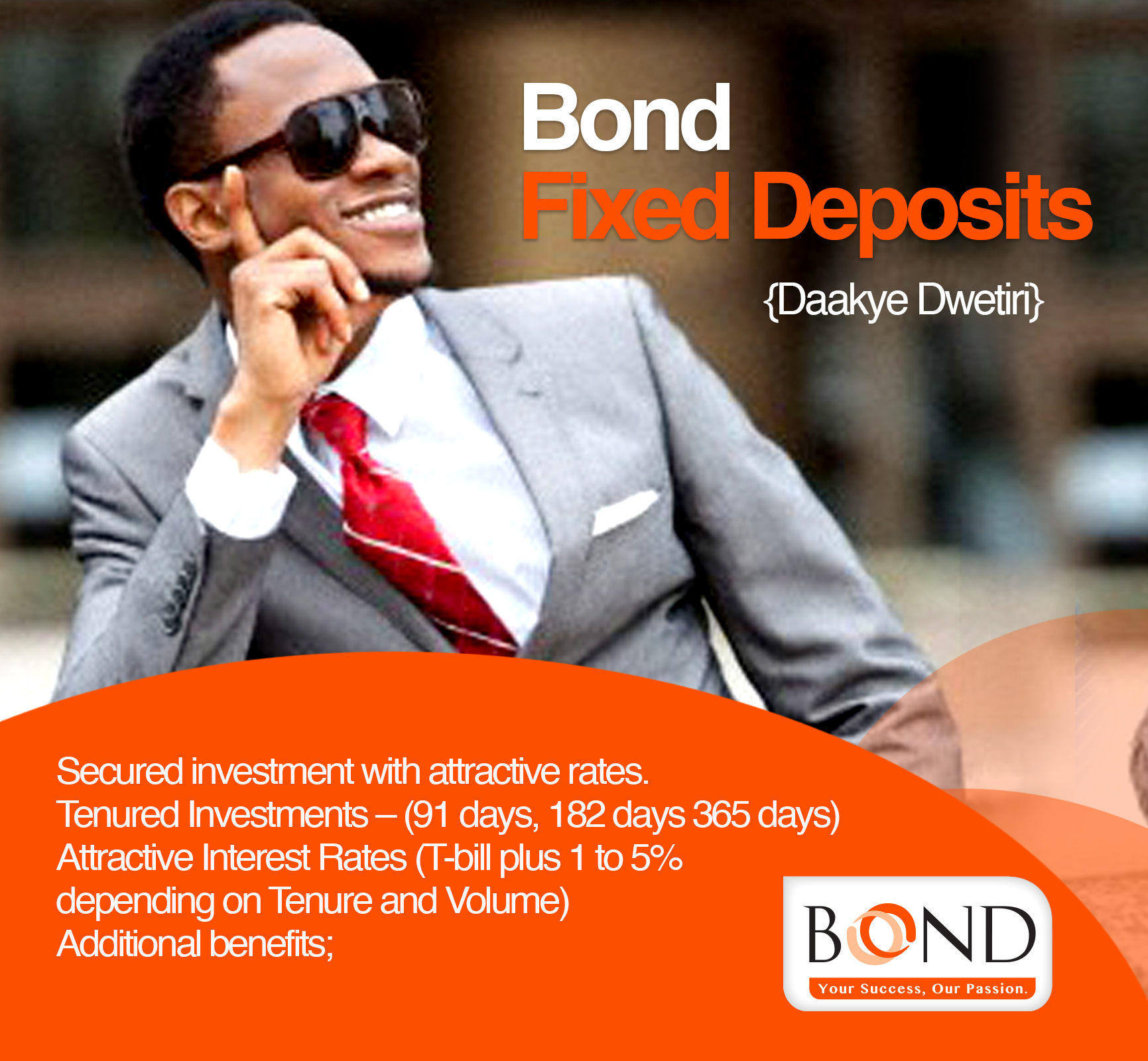

Secure your future with Bond's Fixed Deposit Account. Enjoy guaranteed returns with competitive interest rates and flexible tenure options.

Bond Fixed Deposit Account offers you a safe and reliable way to grow your savings with guaranteed returns. Choose from various tenure options ranging from 3 months to 5 years, with attractive interest rates that increase with longer deposit periods. Your investment is secure, and you can earn regular interest payments or compound them for maximum growth.